Borrowing expense calculator

This calculator helps you work out how much you can afford to borrow. Choose how much you want to save or borrow.

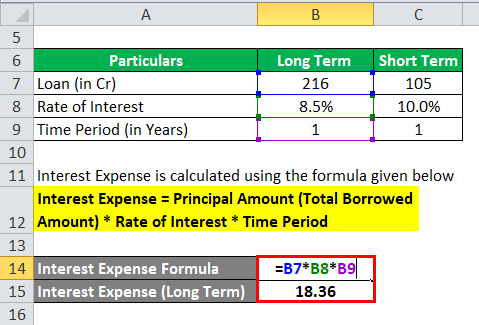

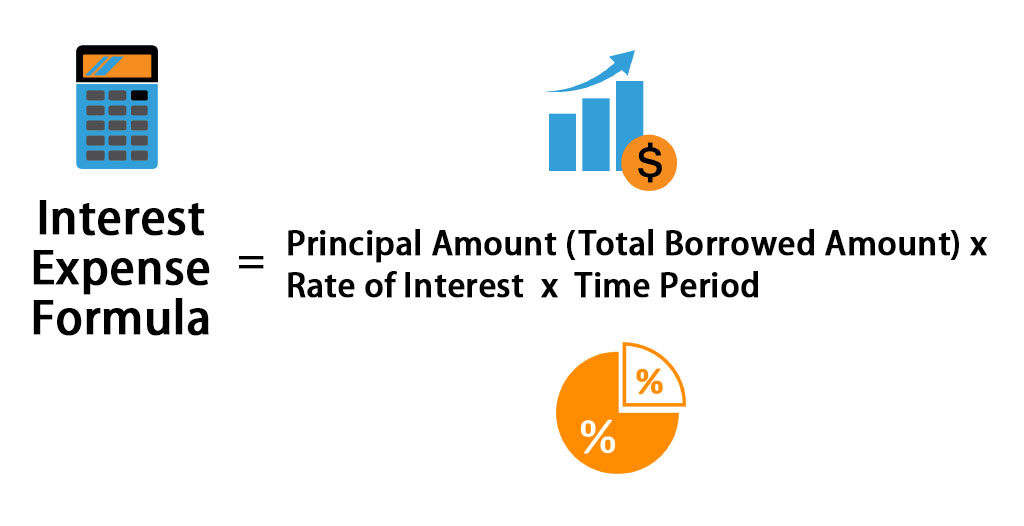

Interest Expense Formula Calculator Excel Template

View your borrowing capacity and estimated home loan repayments.

. It equals pre-tax cost of debt multiplied by 1 tax rate. Enter the amount into the box. This calculator doesnt take into.

GC Mutual Bank Ltd may not provide loans with the details indicated in the calculator. You dont need to add your current rentaccommodation costs if youll be living in your new home. This will show you how the interest rate affects your borrowing or saving.

Total amount payable 1142340. The term of the loan. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Ad Use This Free Calculator To Help Determine If Debt Consolidation Is Right For You. Type into the personal loan calculator the Loan Amount you wish to borrow. Just input your income and expenses and well do the rest.

Our borrowing power calculator will estimate how much you could borrow and what your loan repayments will be so you can figure out if our ubank home loans suits you. Answer a Few Questions Get a Detailed Report On How Debt Consolidation May Help. Input the Annual interest rate for the loan.

You can borrow up to. Subtract your expenses from your income to. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Use the slider to set the. 55 APR Representative based on a loan of 10000 repayable over 60 months at an interest rate of 55 pa fixed. Use the personal loan calculator to find out your monthly payment and total cost of borrowing.

If your borrowing expenses are 100 or less you can claim the full amount in the income year you incur the expense. The specific details of your loan will be. The results from this calculator should be used as an indication only.

W5Cost of the Asset at 31122013 250002000015000 6545 66545. Unemployed this is a private expense borrowing expenses on any portion of the loan you use for private purposes for example money you use to buy. Number of months to repay your loan.

The above definition of the incremental borrowing rate has changed from ASC 840. Results do not represent either quotes or pre-qualifications for a loan. Get an estimate in 2 minutes.

Under ASC 842 the lessee must use a secured rate. MoneySuperMarkets loan calculator is designed to give you an idea how much a personal loan is going to cost. W4 Weighted Average Borrowing Cost Rate.

Even a small change can have a big impact. No Application Fees No Processing Fees. To Use the online Loan Calculator 1 simply.

How to use our calculator. Plan on adding about 10 percent to your estimate. The estimated amount you could potentially borrow is a guide only.

Where your total borrowing expenses are more than 100 you spread the deduction over the shorter of either. Monthly repayment of 19039. Opens new window Select the term for your loan.

Required Calculate the eligible borrowing cost that will be capitalized as part of the cost of the office building and the finance cost that should be reported in profit or loss for the year ended 31 December 2013. No Credit Harm to Apply. Expense insurance premiums where under the policy your loan will be paid out in the event that you die become disabled or.

Tax laws in many countries allow deduction on account of interest expense. Ad Low Interest Online Lenders Personal Loan Calculator Reviews Fast Approval 2022. The calculator doesnt account for costs such as taxes documentation fees and auto registration.

Use our financial calculators to finesse your monthly budget compare borrowing costs and plan for your future. How to claim borrowing expenses. Up to 50000 in 24hrs.

You can borrow up to 381000. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt repayments. You can claim a deduction for the balance of the.

It is the cost of debt that is included in calculation of weighted average cost of capital wacc. Previously the incremental borrowing rate was the rate that at lease inception a lessee would have incurred to borrow over a similar term the funds necessary to purchase the leased asset. Ad Make your home even more perfect with SECUs low rate Home Equity Line of Credit.

From mortgages to retirement plans our calculators allow you to. Calculate how much you can borrow to buy a new home.

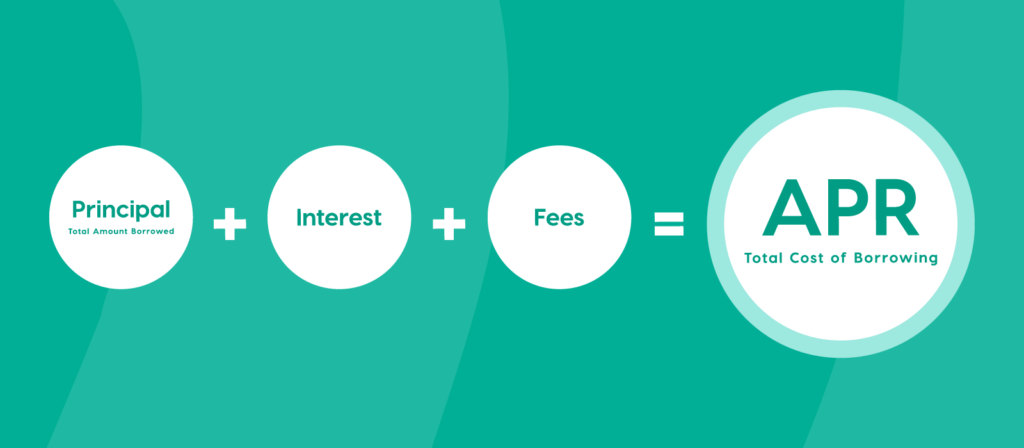

Learn The True Cost Of Borrowing Birchwood Credit

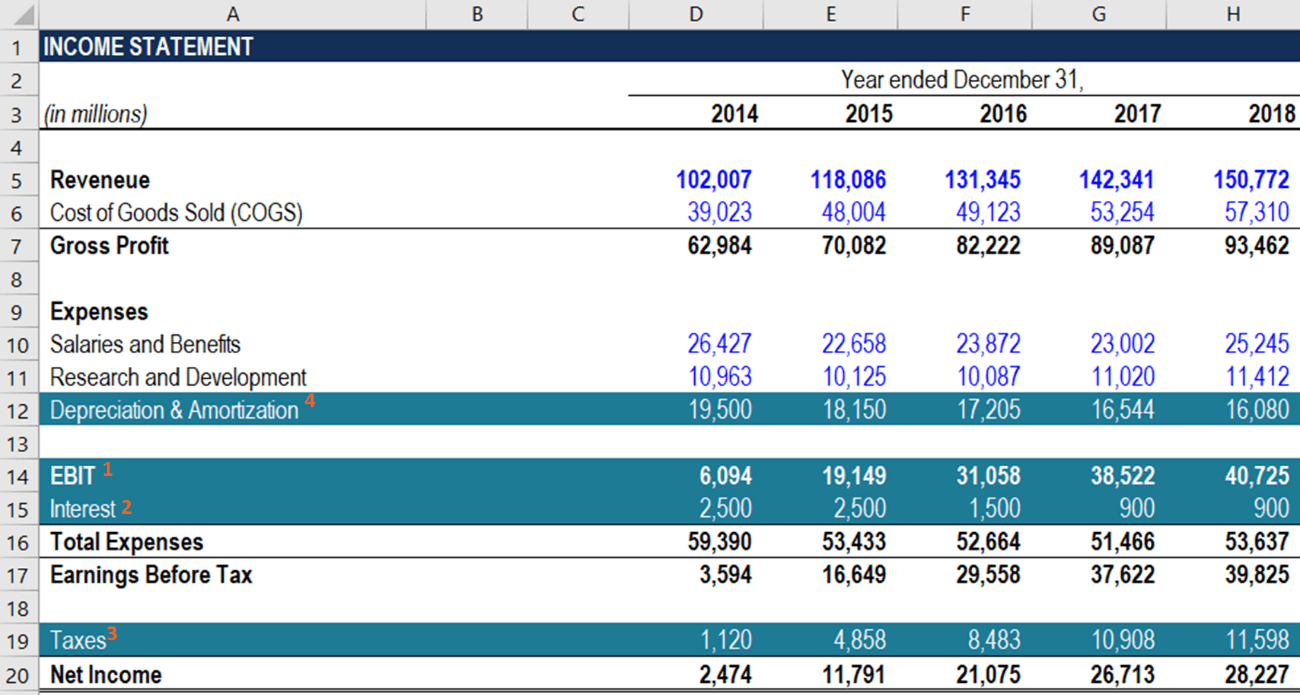

How To Calculate Fcfe From Ebit Overview Formula Example

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

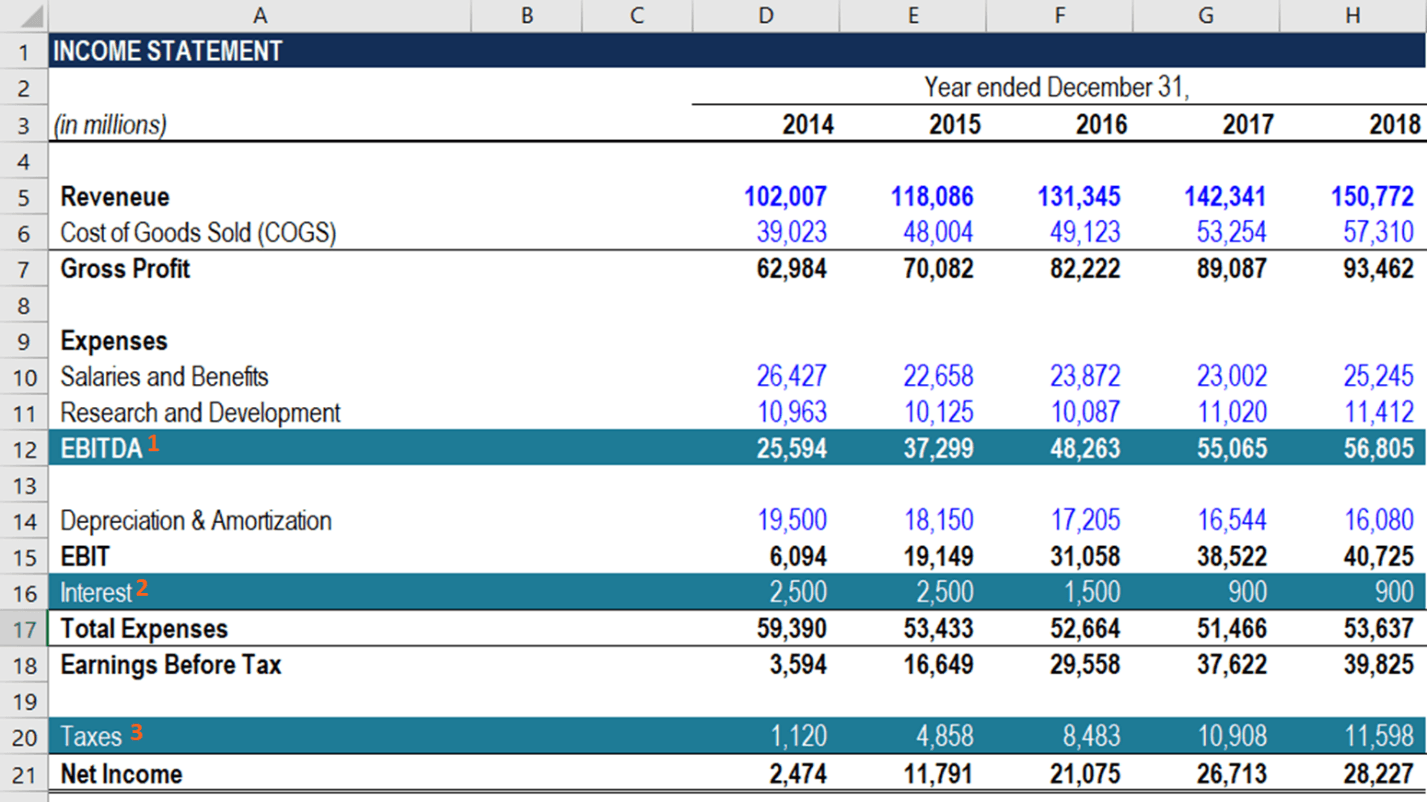

How To Calculate Fcfe From Ebitda Overview Formula Example

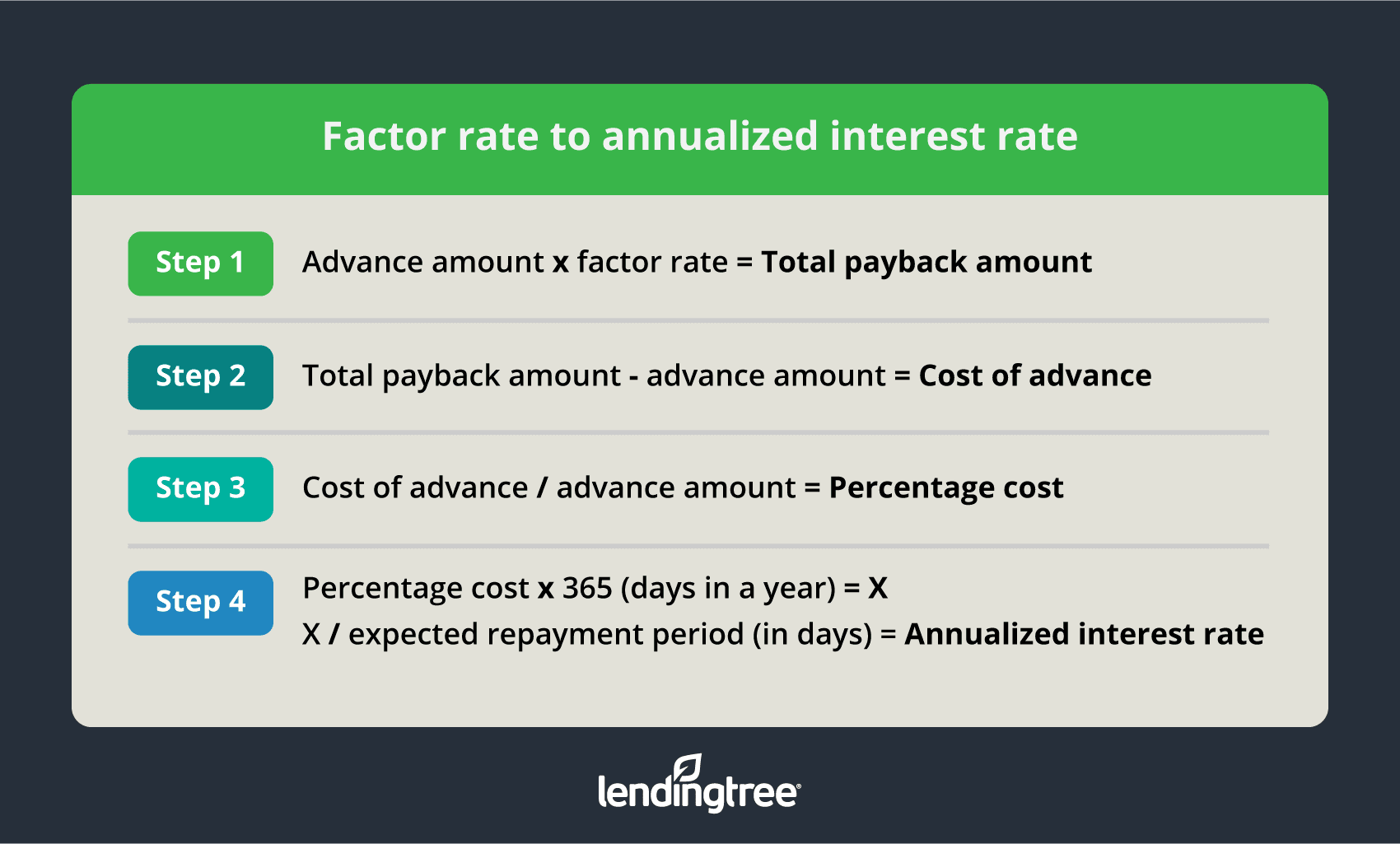

What Is A Factor Rate And How Do You Calculate It

Interest Expense Formula Calculator Excel Template

Free 9 Home Affordability Calculator Samples And Templates In Excel

Interest Expense Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

How Much Can I Borrow Home Loan Calculator

Cost Of Debt Kd Formula And Calculator Excel Template

Borrowing Power Calculator Sente Mortgage

Hard To Borrow Fee Calculation Ally

Lvr Borrowing Capacity Calculator Interest Co Nz

Interest Expense Formula Calculator Excel Template

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

Home Affordability Calculator For Excel